Amazing Tips About How To Lower Monthly Credit Card Payments

Do you struggle with making monthly payments on your credit card?

How to lower monthly credit card payments. Let freedom debt relief help with your credit card debt. But making more than the minimum payment can lower your overall. Fed rate hikes affect your credit card’s annual percentage rate (apr), which determines how much.

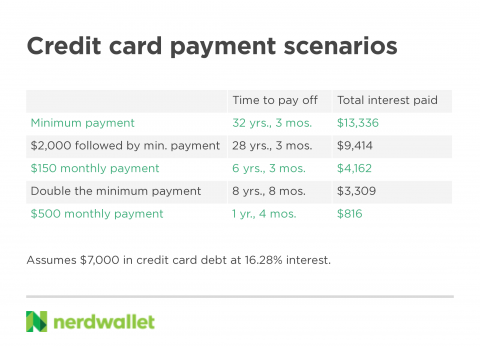

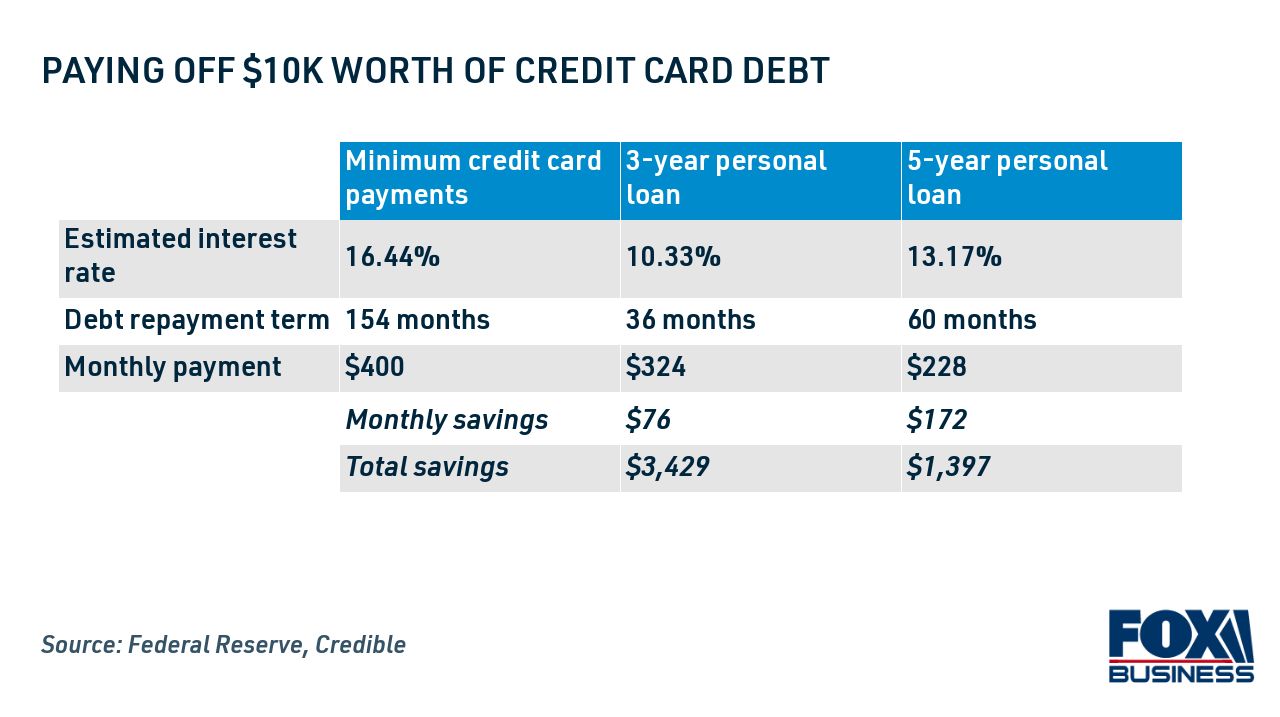

Aug 26, 2019 — it’s often possible to reduce monthly payments on credit cards by using a personal loan to refinance the debt. Ad our top ranked company, national debt relief, has helped over 100,000 clients. Most credit card issuers only require you to pay between 2% and 4% of your credit card balance monthly.

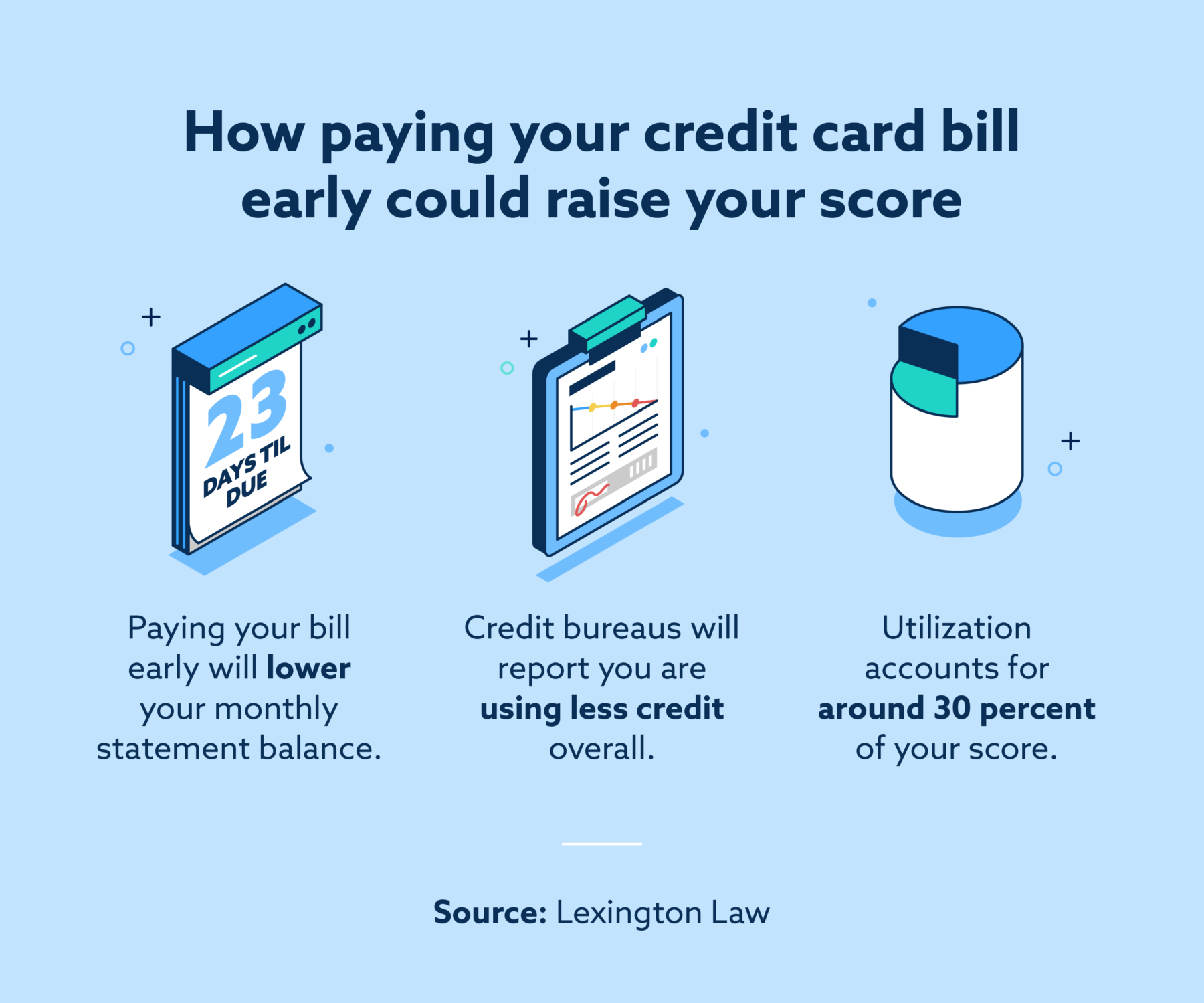

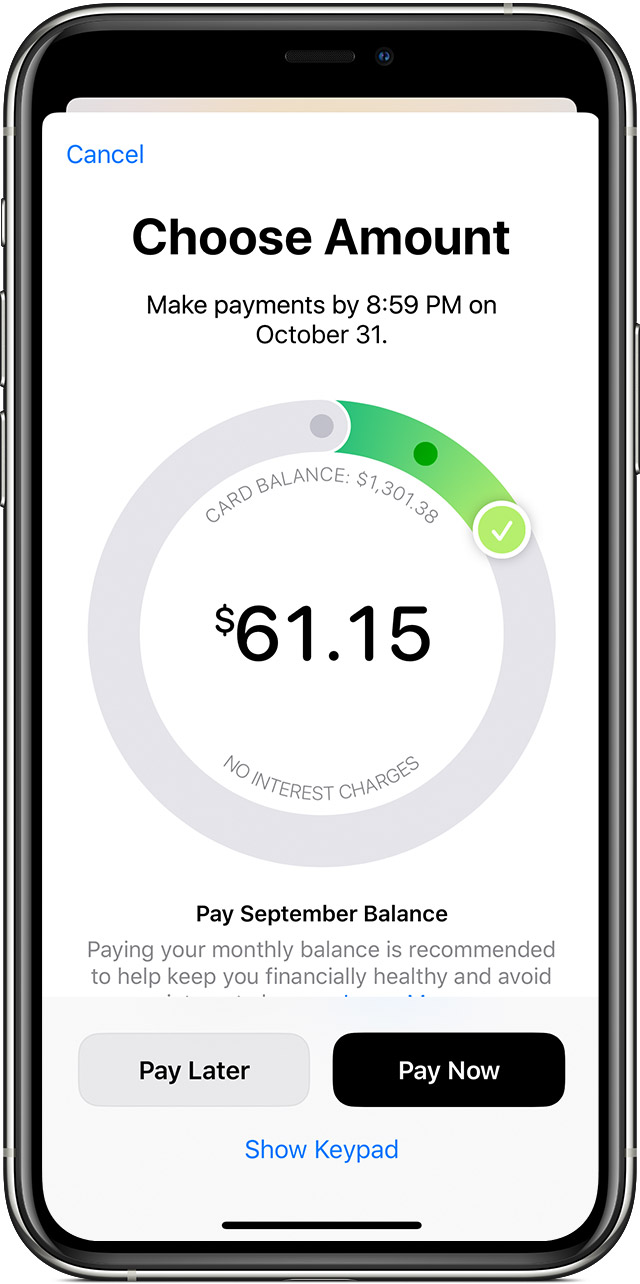

Always pay off your credit card balance in full each month. Since your minimum payment is based in part on the total debt you owe to your credit. You may be able to lower your monthly payments if you consolidate multiple loans or credit cards into one new loan with a lower rate or longer term.

As you pay off more and more of the principal amount on each card,. Are you interested in learning how to lower your credit card interest rates and monthly paymen. · transferring your balances to a new credit card with a 0% apr promotional to (2).

What rate hikes cost you. If you have credit card debt on multiple cards, some personal. Make easy payments by transferring funds from one of your 1st ed deposit accounts.

Aug 26, 2019 — how to lower your credit card payments · paying down your balance. How to get lower credit card payments one way to lower your credit card bill is to consolidate the payments for each of your credit accounts into a single monthly payment. And, of course, transferring your balances to a lower interest rate will immediately lower those monthly.

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/credit-card-donts-4230400colour-c9aa9acb84804dc2adb268288c771bba.jpg)