Best Info About How To Buy California Muni Bonds

As a city bond investor, there are several ways you can invest.

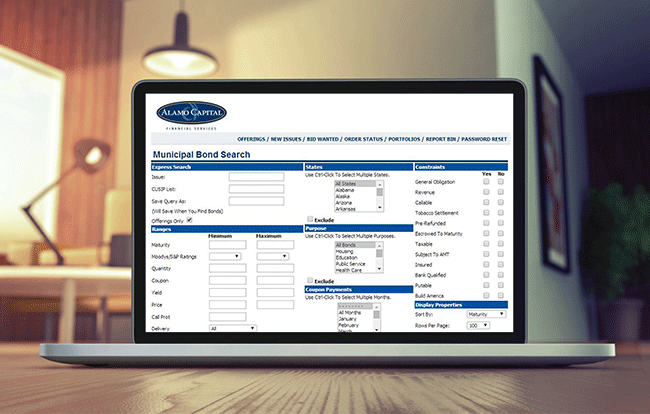

How to buy california muni bonds. These funds typically include revenue bonds. You can do so through either a traditional or online brokerage firm or directly from a mutual fund company. Find everything about california municipal bonds.

Pimco high yield municipal bond fund. Ad don't downgrade your income potential. Buy bonuses alone, investment by bond fund managed by a mutual fund.

The public finance division (pfd) manages the state’s debt portfolio, overseeing the issuance of debt, and monitors and services the state’s outstanding debt. You cannot buy california bonds directly from the state. Now substitute a lower yielding, better quality corporate bond:

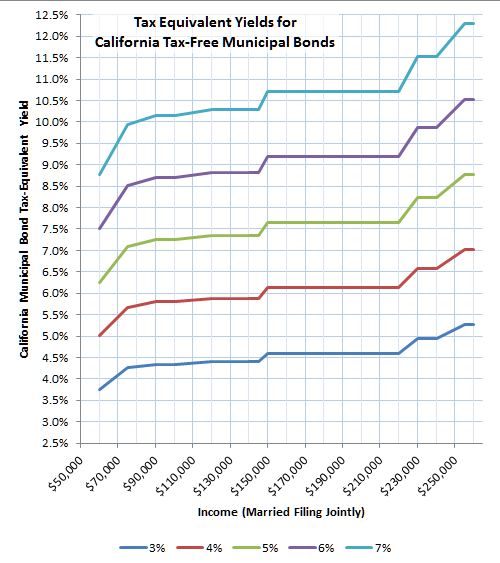

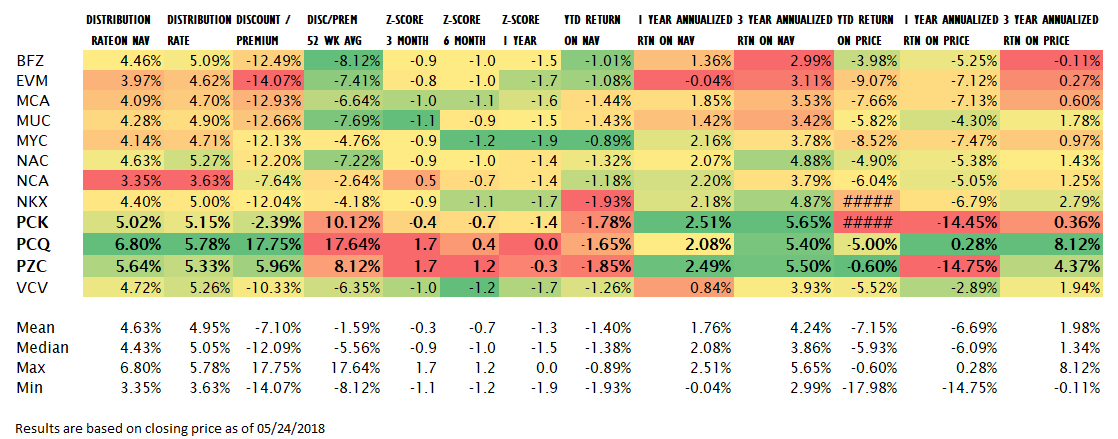

Track cusips, learn about issuers and dive deep into every california municipal bond. A california municipal bond funds and etfs invests in debt obligations issued by a local government or entity in the state of california. One year, two years and three years, for instance.

Hire an investment adviser who can locate and. According to lipper, here are the median yields as of may 31 for retail funds in each california category: Seek high current income exempt from federal tax.

Open a brokerage account with an investment company that has the ability to purchase california bonds. This bond yields 4.33% to maturity. Remember, california has the 7th largest economy in the world, don't let some misleading news make you miss out.